A Quick Take: The Impact of the UK’s New Tax Laws on Carried Interest Compensation and Private Capital Firms

HRsoft

NOVEMBER 7, 2024

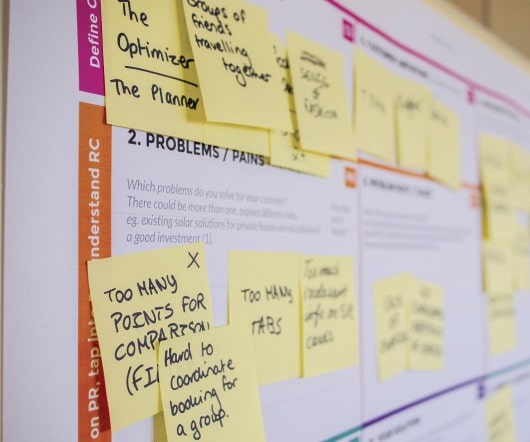

The UK has seen significant shifts with the introduction of new tax laws targeting capital gains, specifically with changes surrounding carried interest compensation. Compensation Structures : Many firms are now reconsidering their compensation frameworks. The tax rate will increase from 28% to 32% for carried interest.

Let's personalize your content